|

ROTH IRA - IRA REAL

ESTATE INVESTMENTS - PAY NO TAX ON GAIN

Diversify and

Protect your Retirement Portfolio - Transfer Tax Free into Real Estate Cash

Flow

Tax

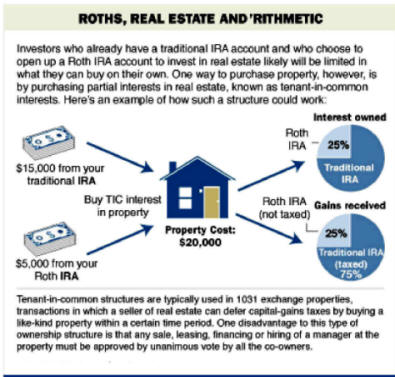

law allows real estate investments to be included in traditional and

Roth Individual Retirement Accounts (IRAs). However, various criteria

must be satisfied for real estate investments to be valid IRA

investments. Costly penalties apply if these criteria are not met.

IRA

investor interest in real estate has increased recently as dramatic

stock market declines have prompted investors to look for ways to

diversify IRA investment risk. Any type of investment real estate can

qualify for IRA investment including apartment buildings, office

buildings and motels.

Establishing a

Self-Directed IRA

Free Consultation Appointment

IRA

real estate investments must be acquired by establishing a self-directed

traditional or Roth IRA through one of three types of IRA trustees - an

IRA custodian, an independent IRA administrator or an IRA advisor.

According to The Wall Street Journal, initial account setup fees can

range from $50 to more than $1,500. Annual fees range from $200 to more

than $500 depending on the type of IRA trustee. The more "hand-holding"

(advice, management, help with paperwork) offered by the IRA trustee,

the higher the fees.

IRA

custodians offer no hand-holding and charge the smallest fees. IRA

advisors provide a full range of services and charge the highest fees.

To find IRA trustees,

contact

1031FEC.

Only

cash can be placed into an IRA. IRA cash can then be used to purchase

real estate, stocks, bonds, mutual funds or other investment assets. IRA

cash can be rolled into a self-directed IRA from the taxpayer's existing

IRAs or from certain corporate pension funds on retirement.

When

IRA real estate is sold, the proceeds can be reinvested in real estate

or invested in other assets. Taxes are avoided as long as funds are kept

in the IRA. If the IRA is a traditional deductible IRA, taxes are

postponed but eventually paid. Taxes are permanently avoided for Roth

IRAs as long as withdrawals comply with IRS rules. Typically, only

taxpayers older than 59½ can make qualified IRA withdrawals.

Because ordinary (not

capital gains) tax rates apply to qualified withdrawals from traditional

deductible IRAs,

Roth IRAs are the

best type of IRA for real estate investment.

One of the primary benefits of using a Roth IRA is that you don't pay income tax when you withdraw funds in retirement.Unfortunately not everyone meets IRS standards to contribute to a Roth IRA. The primary reason individuals are not allowed to contribute is because their incomes exceed the Roth IRA income limits.

Many individuals that did not qualify for income reasons end up investing in 401k plans and Traditional IRAs. With a Traditional IRA you receive a tax break today, but pay income taxes in retirement. This is opposite of what happens with a Roth IRA. (Compare Roth IRAs and Traditional IRAs.)

The IRS has always allowed certain individuals to convert their Traditional IRAs to Roth IRAs as long as they met specific qualifications and paid income tax on the conversion. But high income earners were unable to convert until recently.

No Income Cap to Convert Traditional IRA to Roth IRA

In the past to be able to convert from a Traditional to a Roth IRA your income needed to be under $100,000. The IRS rules have changed and there is no longer an income cap in place.

With the cap removed high income earners can now convert as long as they pay the appropriate tax on the conversion. There is no 10% early withdrawal penalty if the funds move from the Traditional IRA to the Roth IRA in a 60 day window.

Roth IRA Conversion Taxes

When you convert from a Traditional IRA to a Roth IRA you pay income tax on the contributions. The taxable amount that is converted is added to your income taxes and your regular income rate is applied to your total income.

Retirement-Plans/IRA-One-Rollover-Per-Year-Rule: http://www.irs.gov/

Rules for Home Purchase: http://recenter.tamu.edu/pdf/2058.pdf

Why Convert to Roth IRA?

Tax savvy investors want to pay as little income tax as possible. Converting to a Roth IRA allows you to make smart tax moves that will save money in the long run.

If you anticipate your income dropping significantly in a certain year (and increasing in following years) then a conversion could be done in the low income year. Since your income is lower you may be in a lower tax bracket when you convert.

Likewise if the government announced increase tax rate increases to go in effect the following year then a conversion in the current year would save income tax.

Converting to a Roth IRA will guarantee you will owe no additional income tax on the converted funds during retirement. The balance in your portfolio will be what you can tap in retirement and you won't have to calculate an after-tax balance. Other Retirement Accounts You Can Convert Into a Roth IRA

Beyond a traditional IRA, there other tax-deferred retirement plans that can also be converted to a Roth IRA. They include:

•SIMPLE IRA (after two years)

•SEP IRA

•457(b) Plan

•403(b) Plan

•Designated Roth Account (401(k), 403(b), or 457(b) )

Except for the Designated Roth Account, all income must be included as taxable in the year of conversion.

Potential Pitfalls

Interested investors should do their homework before setting up a

self-directed IRA to invest in real estate. If IRS criteria for

self-directed IRAs and qualified withdrawals are not followed, combined

penalties and income taxes can range from 15 percent to more than 100

percent of the real estate's value.

Properties included in IRAs cannot be the investor's personal residence

or purchased from immediate family. There must be enough cash in the IRA

to pay annual property expenses (mortgage, repairs, maintenance) if the

property does not generate sufficient cash flow. Additional funds can be

rolled into the self-directed real estate IRA from other IRAs or certain

corporate pension funds if necessary and tax criteria are met.

Real

estate IRAs have numerous potential benefits and drawbacks. Because of

the complexities of the rules governing these transactions, consultation

with 1031FEC and your tax advisor is recommended.

One may find that that Real Estate IRA investments smaller than

$100,000 may be a challenge for some investors to justify.

Major Article Contribution by

By Dr. Jerrold J. Stern |