|

|

*Investment

Properties

include

Mineral Rights Royalty Income

Medical Buildings

Warehouses

Senior Housing |

1031 Flow Chart Diagram

Replacing

Debt in

1031

Exchanges

Articles

Wall Street Journal

Demand Grows for

Properties Requiring Little Management

Business Week

Everyone into the

Pool TIC Lets You Defer Taxes

National Real Estate Investor

TIC-An Alternate

RE Structure

Section 1031 Tax Code

1031 IRA Discussion

Sample Language for 1031 in Real Estate

Agreement

Top of Page

Top of Page

1031 Flow Chart Diagram

Top of Page

Top of Page

Contact

Us

1031 Flow Chart Diagram

Top of Page

Top of Page

1031 Flow Chart Diagram

Top of Page

With

free Acrobat Reader® software

you

can view and print Adobe PDF files.

Top of Page

1031 Flow Chart Diagram

.jpg)

Top of Page

|

*Investment

Properties

include

Medical Buildings

Mineral Rights-Royalties

Warehouse

Senior Housing

0 Debt TIC Income

Farm & Ranch

Recreational

Land Bank |

1031 Flow Chart Diagram

Top of Page

1031FEC

Your tax solution

Asset Advisors

11031

Flow Chart Diagram

1031 Flow Chart (MS Word)

721

Flow Chart

Top of Page

\

We appreciate

your business.

453 Exclusions

Exchanges

721

1031

1032

1033

1034 (Repealed)

1035

1036

1045

Exchanges

121 Exclusion

(Replaced 1034)

1202 Exclusion

(Business)

1031 Flow Chart Diagram

Contact

1031FEC

for more information

Top of Page

1202 Exclusion

179 Exclusion

469 Exclusion

Top of Page

1031 Flow Chart Diagram

Top of Page

1031 Flow Chart Diagram

Top of Page

Thank you for visiting 1031 FEC

Top of Page |

Pay No Tax

- Properly Structured Tax Free Gain or Partial Tax-Free Income -

Reduce Tax Burden

Free Consultation Appointment

FOR A FREE CONSULTATION

CONTACT US or PHONE

800.333.0801

IRS Section §1031

Basics

"Real

estate offers so many tax advantages it is unique in that it can be used to

postpone capital gain taxes indefinitely."

www.wellingtonpublications.com/hpr/planning/section5.html

"Real Estate"

When income taxes were

first imposed in 1918, gain or loss recognition was required on all

disposition of property. To allow USA citizens to maintain wealth an IRS provision for non-recognition of gain or loss on

the exchange property was introduced in 1921,

§

1031. Since inception, there have

been five major amendments made to the Tax-Deferred Exchange as we know it

today. The real estate tax deferred exchange gained

significant recognition and popularity in the early 1980’s following the

case of Starker vs. United States, which created the 180 day Safe Harbor

period following the sale of an asset to effectuate an exchange. This

procedure is outlined under the

Internal Revenue Code Section 1031,

and involves a series of rules and regulations that must be met in order

to take full advantage of this tax benefit. Since the mid-1980’s billions of dollars of real estate have been successfully exchanged via

this technique.

Getting Started:

Contact

1031FEC. Though 1031FEC and Kenneth Wheeler do not offer tax advice or legal advice, we can guide you in the right direction and

facilitate the efforts of other professionals who will be working with you to

complete the transaction. One needs to consult early with an accountant and

other professional advisors. 1031FEC's goal is to assist,

ease, & expedite the § 1031 property transfer process.

Definition of Real Property for 1031 Exchanges

December 2, 2020, added

new §1.1031(a)-3 to the Treasury Regulations defining real property for

purposes of §1031. The new section clarifies that property defined as real

property under state law is real property for purposes of §1031. Real

property includes land and improvements to land, unsevered natural products

of land, and water and air space superjacent to land. Classification of

property for depreciation purposes does not impact the asset’s character as

real property under §1031.

Improvements are further defined as inherently permanent

structures, or structural components thereof. Improvements include

buildings, enclosed parking facilities as well as paved parking areas,

in-ground swimming pools, stationary wharves and docks, permanent

advertising displays, power generation and transmission facilities,

permanently installed telecommunications cables, microwave transmission,

cell, broadcast and electric transmission towers, oil and gas pipelines,

offshore platforms, derricks, oil and gas storage tanks, grain storage bins

and silos, among other listed structures. For assets not specifically

listed, there are 5 factors to be considered in making a determination:

-

The manner in which the asset is affixed to real

property;

-

Whether designed to be permanent or removable;

-

Damage that removal would cause either to the asset or the real

property;

-

Circumstances suggesting that the asset is not intended to be

indefinitely affixed;

-

Time and expense required to move the asset.

Based upon the above analysis, bus shelters, which are easily removed and

reinstalled elsewhere when routes change, do not qualify as inherently

permanent structures, and would not qualify as real property under §1031.

Conversely, a large sculpture constructed within a building’s atrium,

weighing five tons, which is permanently affixed to the building through

specially designed structural supports, and which could not be removed

without great cost and severe damage to both the sculpture and the building,

would meet this test, and would qualify as real property.

Structural components include distinct assets that are

a constituent part of and are integrated into an inherently permanent

structure, such as wall, partitions, doors, wiring, plumbing and HVAC

systems, piping and other components. For items not specifically listed, the

factors to be considered are:

-

The manner, time and expense of installing and

removing;

-

Whether the component is designed to be moved;

-

Damage that removal would cause to the component or the structure;

-

Whether it was installed during construction of the inherently permanent

structure.

Unsevered natural products of land include growing

crops, plants, and timber; mines; wells and other natural deposits, such as

water, ores and minerals. These items lose their real property designation

once they are severed, extracted or removed.

Intangibles that are treated as real property under

§1031 include fee ownership; co-ownership, leaseholds, options to acquire

real property, easements, stock in a cooperative housing corporation, shares

in a mutual ditch, reservoir, or irrigation company that is treated as real

estate under state law, and land development rights. Licenses and permits in

the nature of a leasehold, easement or similar right, that are solely for

the use, enjoyment or occupation of the land or permanent structure are also

deemed to be real property. Thus a land use permit for a cell tower on land

would qualify as real property, but a business license to operate a casino

in a building would not.

The Final Regulations confirm that intangibles that were previously excluded

under IRC §1031(a)(2), repealed in the TCJA, continue to be excluded,

regardless of classification under state law. These non-qualifying assets

include stock, bonds, notes, securities, debt instruments, partnership

interests, certificates of trust or beneficial interest, and choses in

action.

Incidental Personal Property is addressed in new

Treasury Regulation §1.1031(k)-1(g)(7)(iii), which clarifies that use of

exchange funds to acquire a small amount of personal property, incidental to

the acquisition of real property, will not be deemed to be a violation of

the safe harbor restrictions limiting the taxpayer’s rights to receive,

pledge, borrow or obtain the benefits of the exchange funds prior to receipt

of like-kind property or an exchange terminating event. However, for the

exception to apply, 1) the personal property must typically be transferred

together with the real property in standard commercial transactions, and 2)

the aggregate fair market value of the personal property must not exceed 15%

of the aggregate fair market value of the replacement real property. If

multiple replacement properties are acquired, the 15% threshold is measured

against the total value of all replacement properties.

Importantly, the incidental property is disregarded only for purposes of

determining whether there has been an early distribution of funds; it is not

disregarded for purposes of determining like-kind property. Gain (or “boot”)

will still be recognized on the value of the incidental property acquired.

Checklist outline for a 1031 Exchange transaction requiring planning,

expertise & support.

-

Choose your 1031 Qualified Intermediary (QI)

-

Consult with your tax professionals

-

Include Cooperation Clause language in your purchase and sale agreement

-

QI

prepares your exchange documents

-

Start

searching for Replacement Property

-

Sign

all documents QI prepares

-

Sell

your Relinquished Property

-

Identify your Replacement Property

-

Enter

into contract on Replacement Property

-

Contact QI once Replacement Property escrow is opened

-

Close

on Replacement Property

-

QI

transfers funds to complete your purchase

Your exchange is complete

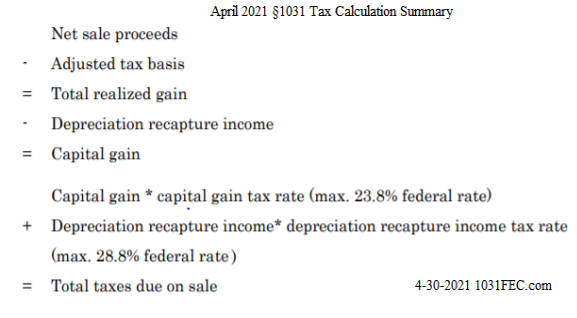

1031FEC April 2021

§1031

Tax Calculation Summary

|

What are the

Basics of a 1031 Property Exchange?

A 1031 Exchange is a mechanism that allows one to defer capital gains taxes

otherwise incurred at the sale of real estate.

Basic Criteria:

1. Properties:

Simplified, both the old property and the new property must be either land,

commercial or rental property (in certain cases, vacation and even personal

residential property also qualify). You can exchange property for other IRS

recognized like-kind property. For example, office buildings could be sold and

apartments purchased or an industrial complex sold and raw land purchased. The

buying and selling transactions can be separate events involving different

parties, just as they would in any arms-length sale and repurchase of

property.

2. Money: You cannot touch the proceeds (money). By law, the proceeds

from the sale of your current property must be held with a Safe Harbor

"Qualified Intermediary or Qualified Escrow Holder" (sometimes also

called an "Accommodator" or a "Facilitator"). You cannot

place the proceeds in escrow until the second property is acquired, nor can

you have a friend, employee, broker, your CPA or attorney hold the money for

you.

3. Timing: From the date you close on the sale of your current

property, you have 45 days to determine a list of up to three properties you

want to own. Also, from the date of closing of the sale of your current

property, you have *180 days to close on the purchase of one or all of the

properties listed on your 45-day list.

Contact 1031 FEC for

more details about this time limit.

*May

be less than 180 days with tax date limits.

4. Reinvestment: To avoid taxable gain, you must reinvest in a property

of equal or greater value. To exchange for property of less value may

cause prorated tax liability.

5. Title: The title-holder of the old, sold property must remain the

title holder of the new property until after the exchange is completed.

For more information |

|

|

1031FEC Documents are in PDF Format

With

free Acrobat Reader® software

you

can view and print Adobe PDF files.

you

can view and print Adobe PDF files.

|

1031 Do's and Don'ts

Do

advanced planning for the exchange. Visit with your accountant, attorney,

broker, lender and Qualified Intermediary (Accommodator).

Do not

miss your identification and exchange deadlines. Failure to identify

within the 45 day identification period or failure to acquire

replacement property within the 180 day exchange period will disqualify

the entire exchange. Reputable Intermediaries will not act on back-dated

or late identifications.

Do

keep in mind these three basic rules to qualify for complete tax

deferral:

Make sure

the debt on the replacement property is equal to or greater than the

debt on the relinquished property. (Exception: A reduction in debt can

be offset with additional cash, however, a reduction in equity cannot

be offset by increasing debt.

Receive

only like-kind replacement property. The IRS

tends to follow a state's property classification.

Note: IRS Section 1245 real property (accelerated depreciation)

can not be exchanged for IRS Section 1250 real property or land.

IRS Section 1245 property is like-kind to many other 1245 properties.

(ask 1031FEC for assistance

with like-kind rules)

Do not

plan to sell and invest the proceeds in property you already own. Funds

applied toward property already owned purchase goods and services, not

like-kind property.

Do

attempt to sell before you purchase. Occasionally Exchangers find the

ideal replacement property before a buyer is found for the relinquished

property. If this situation occurs, a reverse exchange (buying before

selling) is the only option available. Although there is considerable

legal precedent for reverse exchanges, Exchangers should be aware they

are considered a more aggressive exchange variation because no clear IRS

guidelines exist.

Do not

dissolve partnerships or change the manner of holding title during the

exchange. A change in the Exchanger's legal relationship with the

property may jeopardize the exchange.

|

|

Boot

The term "boot" is not used in the

Internal Revenue Code or the Regulations, but is commonly used in

discussing the tax consequences of a Section 1031 tax-deferred exchange.

Boot received is the money or the fair market value of "other property"

received by the taxpayer in an exchange. Money includes all cash

equivalents plus liabilities of the taxpayer assumed by the other party,

or liabilities to which the property exchanged by the taxpayer is

subject. "Other property" is property that is non-like-kind, such as

personal property received in an exchange of real property, property

used for personal purposes, or "non-qualified property." "Other

property" also includes such things as a promissory note received from a

buyer (Seller Financing).

Any Boot Received In

Addition To Like Kind Replacement Property Will Be Taxable (to the

extent of gain realized on the exchange). This is okay when a seller

desires some cash or debt reduction and is willing to pay some taxes.

Otherwise, boot should be avoided in order for a 1031 Exchange to be

completely tax-free.

Boot can result from a

variety of factors. It is important for a taxpayer to understand what

can result in boot if taxable income is to be avoided. The most common

sources of boot include the following:

-

Cash boot taken from

the exchange. This will usually be in the form of net cash received,

or the difference between cash received from the sale of the exchange

property and cash paid to acquire the replacement property or

properties. Net cash received can result when a taxpayer is "trading

down" in the exchange so that the replacement property does not cost

as much as the exchange property sold for.

-

Sale proceeds being

used to pay service costs at closing which are not closing expenses.

If proceeds of sale are used to service non-transaction costs at

closing, the result is the same as if the taxpayer received cash from

the exchange, and then used the cash to pay these costs. Taxpayers are

encouraged to bring cash to the closing of the sale of their property

to pay for the following non-transaction costs:

·

Rent

proration.

·

Utility

escrow charges.

·

Tenant

damage deposits transferred to the buyer.

·

Any other

charges unrelated to the closing.

-

Excess borrowing to

acquire replacement property. Borrowing more money than is necessary

to close on replacement property will cause cash being held by an

Intermediary to be excessive for the closing. Excess cash held by an

Intermediary is distributed to the taxpayer, resulting in cash boot to

the taxpayer. Taxpayers must use all cash being held by an

Intermediary for replacement property. Additional financing must be no

more than what is necessary, in addition to the cash, to close on the

property.

-

Loan acquisition costs

with respect to the replacement property which are serviced from

exchange funds being brought to the closing. Loan acquisition costs

include origination fees and other fees related to acquiring the loan.

Taxpayers usually take the position that loan acquisition costs are

being serviced from the proceeds of the loan. However, the IRS may

take a position that these costs are being serviced from Exchange

Funds. This position is usually the position of the financing

institution also. There is no guidance in the form of Treasury

Regulations on this issue at the present time which is helpful.

Acquisition of ditch

stock or Big T water is a possible issue with the IRS. Most taxpayers

report their exchanges of farm land by taking the position that water on

the farm land is indistinguishable from, and the same thing as real

estate. The IRS has been known to have a different view.

Boot Offset Rules -

Only the net boot received by a taxpayer is taxed. In determining the

amount of net boot received by the taxpayer, certain offsets are allowed

and others are not, as follows:

Exchange expenses

(transaction and closing costs) paid (exchange property and replacement

property closings) offset net cash boot received.

Rules

of Thumb Regarding Boot

Always trade "across" or

up. Never trade down. Trading down always results in boot received,

either cash, debt reduction or both. The boot received can be mitigated

by exchange expenses paid.

Bring cash to the

closing of the Exchange Property to cover charges which are not

transaction costs (see above).

Do not receive

property which is not like-kind.

Do not

over-finance replacement property. Financing should be limited to the

amount of money necessary to close on the replacement property in

addition to exchange funds which will be brought to the replacement

property closing.

Basis

and Depreciation Consideration

The basic concept of

a 1031 exchange is that the basis of your old property passes to your

replacement new property. In other words, if you sold your old property

for $100,000, and bought your replacement new property for the same,

your basis on the replacement new property would be the same. It makes

sense then that your depreciation schedule would be exactly the same. It

is. In other words, one continues the depreciation calculations as if

one continues to own the old property (the acquisition date, cost,

previous depreciation taken, and remaining un-depreciated basis remain

the same).

For additional

depreciation a property purchase above the minimum replacement property

purchase for complete tax deferral is required.

One may have an

interest deduction for replacement property borrowed funds.

1031FEC

recommends your

experienced

1031 exchange and

personal tax advisor to confirm your tax advantages.

IRS

Section

§

121 - Sale of Residence (Does not qualify for a

1031 Exchange)

You may qualify to exclude from your

income all or part of any gain from the sale of your main home. Your

main home is the one in which you live most of the time.

Ownership and Use Tests

To claim the exclusion, you must meet the

ownership and use tests. This means that during the 5-year period ending

on the date of the sale, you must have:

- Owned the home for at least two years

(the ownership test)

- Lived in the home as your main home

for at least two years (the use test)

Gain

If you have a gain from the sale of your

main home, you may be able to exclude up to $250,000 of the gain from

your income ($500,000 on a joint return in most cases).

- If you can exclude all of the gain,

you do not need to report the sale on your tax return

- If you have gain that cannot be

excluded, it is taxable. Report it on Schedule D (Form 1040)

- Consider business property as

replacement with a 1031 exchange

Loss

You cannot deduct a loss from the sale of

your main home.

Worksheets

Worksheets are included in IRS

Publication 523, Selling Your Home, to help you figure the:

- Adjusted basis of the home you sold

- Gain (or loss) on the sale

- Gain that you can exclude

Reporting the Sale

Do not report the sale of your main home

on your tax return unless you have a gain and at least part of it is

taxable. Report any taxable gain on IRS Schedule D (Form 1040).

More Than One Home

If you have more than one home, you can

exclude gain only from the sale of your main home. You must pay tax on

the gain from selling any other home. If you have two homes and live in

both of them, your main home is ordinarily the one you live in most of

the time.

Example One:

You own and live in a house in the city.

You also own a beach house, which you use during the summer months. The

house in the city is your main home; the beach house is not.

Example Two:

You own a house, but you live in another

house that you rent. The rented house is your main home.

Business Use or Rental of Home

You may be able to exclude your gain from

the sale of a home that you have used for business or to produce rental

income. But you must meet the ownership and use tests.

Example:

On May 30, 1997, Amy bought a house. She

moved in on that date and lived in it until May 31, 1999, when she moved

out of the house and put it up for rent. The house was rented from June

1, 1999, to March 31, 2001. Amy moved back into the house on April

1, 2001, and lived there until she sold it on January 31, 2003. During

the 5-year period ending on the date of the sale (February 1, 1998 -

January 31, 2003), Amy owned and lived in the house for more than 2

years as shown in the table below.

| Five Year Period |

Used as Home |

Used as Rental |

|

2/1/98-5/31/99 |

16 months |

|

|

6/1/99-3/31/01 |

|

22 months |

|

4/1/01-1/31/03 |

22 months |

|

| |

38 months |

22 months |

Amy can exclude gain up to $250,000.

However, she cannot exclude the part of the gain equal to the

depreciation she claimed for renting the house.

Contact

1031 FEC

for tax saving alternatives when selling a home with gain above

exclusion allowed.

|

How 1031 FEC Consultants Assist,

Ease,

& Expedite

the

§ 1031

Property Transfer Process

1)

Access to

Premium

Agriculture and Commercial Real Estate Property Provided by the

Highest Integrity National & Regional Companies.

2) No

Fee or small fee for clients.

Most 1031 FEC services supported by

national and regional premium real estate property providers.**

3) Free Consultation

to assist you with your §

1031 real estate exchange property transfer and investment plan.

4)

Experienced

reinvestment assistance

resulting in

full value

diversification for less

risk.

5) Assist to

qualify, locate and match clients to

§ 1031 Managed Premium Replacement

Properties for Tax Advantaged Exchanges or Direct Purchase of Commercial,

Agriculture & Development Land (Land Banking),

assisting Real Estate Property Owners, Sellers,

Investors, their Qualified Intermediaries, Escrow Agents & Professional

Advisors.

6) Ease the § 1031

procedure burden

and

stress. Maintain peace of mind with

1031 FEC experience guiding clients through each step and

groups of documents to help assure IRS compliance and qualification. Reduce

property

transfer stress.

7) Expedite the § 1031 process

by monitoring each necessary phase and encouraging completion of

documentation by all parties resulting in a timely transfer of ownership.

8) Best

§ 1031 Property Management

teams

available with

proven experience, integrity and success results in property income and appreciation without

the stress.

9) Tax, Estate

and Legacy Planning

assistance

by matching the right income property to minimize, and in some

cases, defer income tax permanently with

1031 FEC Consultation and Advisory

Services. Personalized investment strategies assist to produce a

greater after tax return. Tax savings and deferment can be thousands

of dollars and $ millions for some property owners.

10) Tax Planning

assistance

by

performing a

Property Cost

Segregation Study

(PCSS). Tax

reduction, savings and deferment could lower and save current tax dollars due now

and in the future for many property owners.

11)

Retirement Planning

assistance with plans that place usually taxed

income to IRS approved retirement funds allowing deductions to $100,000 and tax savings up to $40,000 annually.

Roth IRA alternatives considered to allow no taxation.

Year End Exchanges

The ability to terminate the

exchange by prematurely filing the tax return for the tax year in which the

transfer of the relinquished property occurs. In other words, if you have a

year-end exchange – for instance, if you sold your property in October, but

won’t be purchasing the replacement property in the exchange until February

– don’t file your taxes until you’ve completed the purchase of the

replacement property, and have completed the exchange! If you file your

taxes for the year in which you sold your property before you purchase the

new property within the exchange, the exchange will be automatically

terminated and you will not defer the capital gains. You will owe

all the taxes on your sale. If you are in a year-end exchange situation

and you will not complete the exchange before your accountant files your

taxes (aka April 15th), then FILE FOR AN EXTENSION.

We Assist

You to Find Premium 1031

Exchange Properties within Your 45 days

from

Closing to Identify Replacement Property

§ 1031

Premium TIC Exchange - What is a Tenants-In-Common Investment?

IRS

(Internal Revenue

Service) IRC (Internal

Revenue Code) § 1031

TIC and

§ 721

TIC real property exchanges and

stock exchanges remain popular for tax-deferral. Generally two to

eight owners of single property allow owners to purchase larger more secure

leased real estate.

Tenant in Common

is a form of holding title to real property. It allows the owner/owners to

own an undivided fractional interest in the entire property. In addition,

it has become the preferred investment vehicle for real property investors

who wish to defer capital gains via a

§ 1031 exchange and own real property

without the management headaches.

The following factors have increased the popularity of

Tenant-in-Common (TIC) investments:

-

Today's modern investor demands an investment portfolio that includes real

estate diversification, appreciation and income without the hassle of

active property management

-

The IRS complied to allow the public investor access to passive real

estate investment in March, 2002 by clarifying TIC guidelines in

Revenue Procedure

2002-22

-

The investment property marketplace is over 4 trillion dollars

-

In some states, 90% of all investment properties listed and sold over 3

million dollars were involved in a § 1031 Tax-Deferred Exchange

-

Most non-institutional investors (individuals) are not familiar with the

strict provisions of the IRC §1031

-

Owner age shift: 170,000 reach the age of 65 daily

|

Conventional Direct

Ownership

Property Exchange

|

1031 FEC

Tenant-in-Common

Premium Property Exchange |

|

Lower returns on less desirable properties |

Higher returns on institutional-quality properties |

|

Difficult to comply with § 1031 45 day ID rules; exchanger must find

properties |

Easy to comply with § 1031 45 day ID rules; 1031 FEC

assists to choose properties |

|

Difficult to match § 1031 exchange debt and equity |

Easy to match § 1031 exchange debt and equity |

|

Investor must negotiate and arrange loan |

Prearranged financing |

|

Expensive and time-consuming property management |

Professional proven property management in place. You receive a

monthly or quarterly income check. |

|

Cash flow, depreciation, and appreciation potential |

Cash flow, depreciation, and appreciation potential |

|

Ability to use the § 1031 exchange again |

Ability to use the § 1031 exchange again |

|

Ability to refinance and distribute proceeds “tax free” |

Ability to refinance and distribute proceeds “tax free” |

In a 1031FEC Premium Tenants-in-Common (TIC)

investment you are a co-owner of an entire property. You title as an owner in an

undivided interest in the property along with other investors. For example, as a

TIC investor in a multi-tenant office, you share in the ownership of the entire

property, not a specific office space. Likewise, if you invest in an apartment

complex, you share in the ownership of the entire property, not a specific unit.

IRS §

Section 1032 advantages exchange of stock for property with no gain or

loss recognized to a corporation on the receipt of money or other property

in exchange for stock (including treasury stock) of such corporation. No

gain or loss shall be recognized by a corporation with respect to any lapse

or acquisition of an option, or with respect to a securities futures

contract (as defined in section 1234B), to buy or sell its stock (including

treasury stock). For basis of property acquired by a corporation in

certain exchanges for its stock, see your tax advisor, your Qualified

Intermediary and 1031FEC.

IRS §721

("721 Exchange") or upREIT allows a Taxpayer to exchange rental or investment real

estate ultimately for shares in a Real Estate Investment Trust (REIT). This

is called a

§721

exchange, also known as an upREIT or

§1031 / 721

exchange.

Your

1031FEC Consultant can advise in detail for your personal

portfolio.

What is an UPREIT?

An Umbrella Partnership Real Estate

Investment Trust or UPREIT implements the use of both The Internal

Revenue Code Section

§1031

and

§721.

In an UPREIT structure, the investor executes a 1031 exchange TIC into one

property in which he/she will co-own for about 12-18 months. At that time

the investor will implement a

§ 721

exchange in which he/she will contribute a property to a partnership. At

this point the investor receives interest in the partnership called

operating partnership units (OP units).

§ 721

exchanges are often used by real estate investment trusts (REITs), which

typically own all or substantially all of their assets through a subsidiary

partnership with the REIT acting as general partner.

In a

§721

exchange or UPREIT structure, rather than taking possession of another

property, the investors receive OP units that carry the economic benefits of

the REIT’s entire portfolio, including any capital appreciation and

distributions of operating income. OP units can be converted later into

shares of the associated REIT, and may only be taxable when such a

conversion or liquidation takes place.

IRS §1031

and §721 TIC

exchange

investments are structured to defer capital gains

and recapture of depreciation taxes in

accordance with 1031 exchange requirements.

Reduce risk by identifying 1031FEC

Premium TIC replacement property for your

1031 Exchange. Identify multiple TIC Properties. Or, acquire

interest in multiple TIC Properties. One may directly acquire TIC or

most properties without an exchange.

•45

days is a very short time to locate a qualified property.

Using

the 3-Property Rule, one can identify a 1031FEC

Premium TIC Property as one of

your properties. If the other

choices fail to close, the entire proceeds can easily be applied to the

TIC property.

•If

you do replace with one whole property and have proceeds left, you can

put these remaining proceeds into the TIC property identified.

•Failure

to close under 1031 time limit is the #1 reason clients reveal as to

why many sellers pay capital gain taxes!

This is an open investment

program. This means that the properties are already purchased and the

investment program structure is in place, eliminating the risk of time

and uncertainty in identifying a replacement property.

Simplicity and speed are achieved due to the efforts

of an experienced real estate principal. Negotiation process is complete.

Surveys, Rent rolls, etc. are already completed and available for

your review. Non-recourse Financing is in place.

After your review of all due diligence used to acquire the property,

and upon your approval, you are ready to close!

Closings

can be complete in days, not months.

The TIC

structure has various features that make it attractive to the real

estate buyer:

Access to Preferred

High

Grade Properties

from Reputable National Real Estate Companies - The typical investment in whole commercial building begins at $1

million, but through premium TIC ownership, the average person is able to

enjoy ownership in an institutional-type property with a minimum

investment. Besides reliable income and growth potential, these

high quality properties are able to attract tenants with greater financial

strength and stability than possible for the individual landlord.

Combined Real Estate

Experience - As

an alternative to sole ownership of real estate, a 1031 buyer can

take ownership in a large preferred commercial property along with other

unrelated buyers, not as limited partners, but as individual owners.

Each of the TIC owners brings their previous real estate knowledge

to the group. Thus, each decision of the TIC ownership will be

backed by many years of real estate experience.

Lessee Management with

up to 25 Years

Experience in Real Estate

- Most of the day-to-day property operations are handled by a Master

Lessee. The lessee managers control or has involvement in more

than $350 million in real estate assets and have extensive experience

in real estate. Thus, situations that arise in day-to-day operations

will be addressed quickly and efficiently, and the Premium Property TIC owner will

enjoy the freedom from property management.

Simple Mailbox

Management - The

Premium TIC property owner avoids the time and frustration of dealing with multiple

tenants. You no longer deal with "toilets, tenants and trash," and

simply receive your monthly lease payment from your mailbox. Enjoy

other interests, travel and time with family.

Exact Dollar Matching

- In a Premium TIC property, you may be permitted to purchase any amount above the minimum.

For example, if you have $152,479 of equity from the sale of a

previous property you can purchase $152,479 of equity in a TIC

property.

Low Minimums

- Revenue Procedure 2002-22 issued by the IRS allows up to 35 TIC

owners in any one property. Most TIC owners number 15-25 per

property. Minimum purchase requirements are

structured to meet this limitation and can range as low as $50,000

equity.

Non-recourse

Financing - The

mortgages on most of the Premium TIC properties offered are non-recourse. The TIC debt structure generally allows

for the debt financing to assumed. Assumption usually occurs without

the need for qualification or loan assumption fees.

Diversification

- Due to the low minimums in Premium TIC properties, the buyer can decrease

risk by diversifying into different properties in various different

marketplaces.

Speed and Simplicity

- Speed and

simplicity are achieved due to the efforts of 1031 FEC

Consultants,

Associates

and experienced real estate professionals.

The negotiation process is complete, and survey, rent rolls, etc.

are already completed and available for your review. After your

review of all the due diligence used to acquire your property, and

upon your approval, you are ready to close. The closing can be

completed in days, not months.

No Closing Costs

- Some property investments include closing costs. Be sure of all costs

in a purchase or exchange. Absent seller default or other items outside the control of

1031FEC, closings are generally within the agreed upon time frame.

1031 FEC does not charge the TIC owners closing costs.

Non-FEC1031 triple-net Master Lease transactions generally result in

client closing expenses.

1031 Qualified

Intermediary fees are paid by the buyer/exchanger.

Deeded Interest

- The Premium TIC owners buy the property and receive a deeded interest. You

can transfer this interest by gift, sale, inheritance, assignment,

etc. Such transfer does not need to coincide with the transfer of

all TIC interests in the property. If requested to do so by the TIC

owner, 1031FEC will assist in the marketing of any TIC interest.

No Special

Allocations - All

the Premium TIC owners receive lease payments, sale proceeds and the

depreciation tax benefits in proportion to their percentage

ownership in the property.

Impasse Resolution

Procedure - On a

decision requiring unanimous vote, such as a sale decision, a 75%

vote by the TIC owners may be sufficient to initiate the impasse

resolution procedure. This procedure allows the TIC owners with 75%

or more of the property to make an offer to buyout the dissenting

owner with 25% or less of the property. The dissenting TIC owners

can either: (1) accept this offer, (2) buy out the 75% TIC owners at

the same price per percentage ownership, or (3) change their

dissenting vote to a consenting vote.

Financial

and Estate Planning

- 1031FEC assists with

your family financial and estate planning

in mind that can result in wealth building using risk tolerance and

diversification considerations and passing of wealth to heirs with

minimum or no tax.

As a leader in locating and providing qualified managed premium

§1031 Tenants-in-Common (TIC) replacement

properties,

1031FEC

can offer owners advantages for success. 1031FEC

can assist finding the proper 1031 property for your business requirements that can

defer

capital gains tax and recapture of depreciation taxes. 1031FEC

Consultants

advise you and

your CPA to assist proper IRS

documentation and procedure.

Reduce stress of management or income collection with 1031FEC

TIC

and other qualified income properties.

Our

1031FEC Premium TIC Program provides real estate buyers with the monthly rental

income advantage of a triple-net lease with scheduled increases plus single-tenant property with the

appreciation advantages of a multi-tenant property. By owning TIC interests

in premium multi-tenant commercial properties across a wide geographical area, real

estate buyers can enjoy the diversification that is not possible if you were

to buy just one single location property.

The 1031FEC

Managed Premium TIC Plan

is well-suited for the 1031 Real Estate Exchange Property buyer seeking monthly income that

increases annually, unlimited appreciation potential, and flexible and easy

closings. Current and future 1031 exchange property owners and direct

purchasers now have access to the

advantages of a long-term, triple-net lease without the disadvantages.

No Fee to 1031 FEC 1031

Exchanger

Client. Fee paid by 1031 real estate property provider.

FEC1031 Exchange Checklist

A

1031 Like Kind Exchange transaction requires planning,

expertise and support. Follows is a checklist outlining key

steps in an exchange.

How to do a 1031 Exchange - Outline

1.

Choose your 1031 Qualified Intermediary (QI)

2. Consult with your tax professionals

3. Include Cooperation Clause language in

your purchase and sale agreement

4. QI prepares your exchange documents

5. Start search for Replacement Property

6. Sign all documents QI prepares

7.Sell your Relinquished Property

8. Identify your Replacement

Property

9.

Enter into contract on Replacement Property

9. 10. Contact QI once Replacement

Property escrow is opened

11. 11.

Close on Replacement Property

12. QI transfers funds to complete

your purchase

Your exchange is complete

How to do a 1031 Exchange – Key Steps

1.

Choose your 1031 Qualified Intermediary – QI

as exchange accommodator will prepare the documentation for

the 1031 Exchange, and most importantly, safeguard your

exchange funds.

2.

Consult with one’s tax professionals –

Most Qis are excellent resources and will provide a great

deal of information about like kind exchanges, however we

cannot provide legal or tax advice. Engage your legal, tax,

and/or financial advisors to review your specific

circumstances. Although this is not mandatory for your 1031

Exchange, QIs recommend that investors should always seek

advice from their advisors.

3.

Include Cooperation Clause language in one’s

purchase and sale agreement

– Instruct one’s real estate agent or attorney to include a 1031

Exchange Cooperation Clause in the contract /

purchase and sale agreement.

4.

Qualified Intermediary prepares one’s

exchange documents –

After the contract is signed, contact your QI executive

directly, QI will prepare 1031 documents that need to be

signed prior to closing.

5.

Start searching for Replacement Property –

Remember that once one closes on the Relinquished Property,

the clock starts ticking and you only have 45

days to identify your new Replacement Property. 45

days comes very quickly, so start looking at your options

now.

6.

Sign all documents QI prepares –

Sign all documents QI prepares PRIOR to the transfer of your

Relinquished Property and determine sale proceeds to be

placed into your Exchange.

7.

Sell your Relinquished Property –

complete the transfer of your Relinquished Property.

8.

Identify your Replacement Property –

By midnight of your 45-day deadline, complete the

Identification form and deliver it via fax, email, mail to

IPX1031.

9.

Enter into contract on Replacement Property

adding the Cooperation

Clause language.

10.

Contact QI once Replacement Property escrow

is opened.

QI will prepare all necessary documents for one to sign and

to review with the tax/legal advisors.

11.

Close on Replacement Property

12.

QI transfers funds to complete your purchase –

once your transaction closes, QI will transfer your exchange

funds.

Your exchange is complete. Report

the 1031 Exchange on IRS Form 8824 for the tax year your

1031 Exchange began.

|

Overview of the Reverse 1031

Exchange

Follows

is a very brief and concise overview

of Reverse 1031 Exchanges.

1031

Exchange transactions, especially

Reverse 1031 Exchanges, are complex

tax-deferred tax strategies.

You should always seek competent

legal, financial and tax counsel

before entering into any Forward or

Reverse 1031 Exchange transaction.

1031FEC can assist.

Reverse 1031 Exchanges

There

are many reasons why you might find

yourself in a position where you

must acquire or would prefer to

acquire your like-kind replacement

property first before you sell your

current relinquished property in

your 1031 Exchange.

You

might unexpectedly find an

investment opportunity that you must

act on before you even have time to

consider selling or listing your

current relinquished property.

The sale or disposition of your

relinquished property may

unexpectedly collapse and you do not

want to lose your acquisition that

is closing soon. Or, you may

prefer to buy first to eliminate the

pressure of having to identify your

like-kind replacement property

within the 45 calendar day

identification deadline in a regular

Forward 1031 Exchange.

What

ever your reason for deciding to

purchase your replacement property

first, the Reverse 1031 Exchange

allows you to acquire your like-kind

replacement property first and then

subsequently list and sell your

relinquished property within the

prescribed 1031 Exchange deadlines.

It can be a great strategic tool

when needed or preferred.

Revenue

Procedure 2000-37

The

Internal Revenue Service issued

Revenue Procedure 2000-37 on

September 15, 2000, which provides

guidance on how to properly

structure a Reverse 1031 Exchange

transaction by using a parking

arrangement in conjunction with a

simultaneous 1031 Exchange.

Simultaneous 1031 Exchange

The

actual 1031 Exchange portion of your

Reverse 1031 Exchange transaction is

a simultaneous or concurrent 1031

Exchange either at the beginning or

end of your Reverse 1031 Exchange

transaction. You will enter

into a 1031 Exchange Agreement with

a Qualified Intermediary for the

administration of your 1031

Exchange.

Parking Arrangement

You will

enter into another agreement called

the Qualified Exchange Accommodation

Agreement ("QEAA") that will

structure the parking arrangement

for your Reverse 1031 Exchange.

The QEAA is signed by you and a

1031 Intermediary

as your Exchange Accommodation

Titleholder ("EAT"). The

Exchange Accommodation Titleholder

("EAT") is the entity that will

acquire and hold or "park" legal

title to either your relinquished

property or your like-kind

replacement property during your

Reverse 1031 Exchange transaction.

Reverse 1031 Exchange Structures

The

challenge in structuring your

Reverse 1031 Exchange is deciding

which of your investment properties

will be acquired and held or

"parked" by the 1031

Intermediary

as your Exchange Accommodation

Titleholder ("EAT"). The

structure selected by you will

depend on whether there is financing

involved and which investment

property your lender will allow the

1031 Intermediary

to hold or park legal title to.

The two

structures are commonly referred to

as Exchange Last and Exchange First

because the simultaneous 1031

Exchange occurs either at the

beginning (Exchange First) or at the

end (Exchange Last) of your Reverse

1031 Exchange transaction.

Exchange Last Structure

The

Exchange Last Reverse 1031 Exchange

structure is the preferred strategy

because it will provide you with the

most flexibility in terms of

structuring and financing your

Reverse 1031 Exchange transaction.

It also provides you with more

advanced structuring capabilities.

Your

like-kind replacement property is

acquired and held or "parked" by the

Exchange Accommodation Titleholder

("EAT") and a simultaneous or

concurrent 1031 Exchange is

completed later at the close of your

relinquished property sale

transaction (i.e. the simultaneous

1031 Exchange occurs at the back-end

of your Reverse 1031 Exchange).

The

primary obstacle with this structure

will be your lender. Lenders

are concerned about the Exchange

Accommodation Titleholder holding or

parking title to the like-kind

replacement property that will be

used as collateral for the loan.

We recommend scheduling a conference

call between you, your lender and the

1031 Intermediary

as early as possible to determine

whether this Reverse 1031 Exchange

structure is viable. You may

need to shop around for lenders who

are willing to work with you.

We can certainly assist you with

this.

Exchange

First Structure

A

Reverse 1031 Exchange structure

should keep your lender happy, but

will eliminate your flexibility in

terms of structuring and financing

the acquisition of your like-kind

replacement property and any

advanced 1031 Exchange planning

capabilities.

Your

like-kind replacement property will

be acquired directly by you, your

lender will lend directly to you on

the acquisition of your like-kind

replacement property, and

simultaneously you will transfer

title of your relinquished property

directly to the 1031

Intermediary

as your Exchange Accommodation

Titleholder (i.e. the simultaneous

1031 Exchange occurs at the

front-end of your Reverse 1031

Exchange).

The

difficultly with this structure is

that you must temporarily advance

(i.e. reinvest) the total amount of

your equity that is currently

trapped in your relinquished

property into your like-kind

replacement property up front before

your relinquished property sale

actually closes. This kind of

cash liquidity is usually not

available.

Separate Special Purpose Entity

The 1031

Intermediary will set-up a

separate

special purpose entity in the form

of a separate single member limited

liability company that will be used

exclusively for your Reverse 1031

Exchange transaction.

The 1031 Intermediary should

never hold title to multiple

clients' real or personal property

in the same special purpose entity.

The sole purpose of this entity is

to acquire and hold or "park" legal

title to your Reverse 1031 Exchange

property.

Reverse 1031 Exchange Deadlines

Deadlines for your Reverse 1031

Exchange are essentially the same as

in a forward 1031 Exchange

transaction. You have 45

calendar days to identify what you

are going sell as your relinquished

property, and you have an additional

135 calendar days — for a total of

180 calendar days — to complete the

sale of your identify relinquished

property and close out your Reverse

1031 Exchange.

Reverse 1031 Exchange Fees and Costs

Reverse

1031 Exchanges are more complicated

and costly, so you need to review

the amount of depreciation recapture

and capital gain income tax

liabilities being deferred to ensure

that the cost of the Reverse 1031

Exchange transaction is justified.

We at 1031 FEC would be happy to

assist you.

See Qualified

Managed and Other Premium Investments Featured

Real Estate Investment

Properties & state locations with minimum investment equity are at

Investments.

Does your property qualify for

this

tax break?

For a no fee confidential consultation

and for more details

contact 1031 FEC. We

also can find if you qualify for a retirement tax deduction up to $100,000

for you and up to $100,000 for your spouse. We

recommend your tax advisor or CPA be invited to consult and confirm details.

Other 1031FEC Exchange

Advantages

-

Relieves the burden of active real estate ownership or

"headache" properties (mailbox management by owners with owner

controls).

-

An

experienced

1031FEC exchange advisor to consult and

assist you to choose the best preferred exchange investment for your portfolio

with financial planning, estate planning, diversification and risk

tolerance considerations.

-

Exchange a non-cash flow or low cash flow producing property for a

premium

higher cash

flow producing property.

Increase and earn more income.

-

Access to

ownership of income property in preferred, high grade quality

corporate buildings, shopping centers, multi-residential and other triple

net lease property in advantaged locations.

-

Experienced proven and successful management plus the

possibility of the advantage of the combined real estate experience

of several owners.

-

Diversify your real estate and investment portfolio by geography, property and

investment type. Exchange one property for two or more for a

lower risk

property portfolio.

-

Relocate property

when owner retires, changes location for work or health reasons.

-

Facilitate

estate planning.

Heirs receive property at the

new 'stepped up' basis. Multiple beneficiary solution transfers individual

or multiple properties by a will or Trust.

-

Consolidate many properties into

less parcels for a single or

more

manageable parcels.

-

Gain

leverage for a larger or a more valuable property

-

Access to

cash

with a partial exchange.

-

Low minimum

property investments and possible dollar matching exchanges.

-

Exchange slower appreciating property for preferred property with

increasing income and appreciation.

-

Relieves the burden of future potential

loss of value of

temporarily inflated agriculture land or other inflated property values.

Maintain wealth with higher quality income property.

-

Avoid tax penalties and taxation burden with 1031FEC

consultants to assist and guide you through the §1031 process to help

assure IRS compliance, procedure and documentation.

-

Non-recourse

financing.

-

Retirement Plan

deductions possible.

FIRPTA Withholding Rules

Foreign Investment in

Real Property Tax Act of 1980

UNDERSTANDING THE REQUIREMENTS AND THE EXCEPTIONS

Congress enacted the Foreign

Investment in Real Property Tax Act of 1980 (FIRPTA) to impose a tax

on foreign persons when they sell a U.S. real property interest. A

“foreign person” includes a non-resident alien, foreign

partnerships, trusts, estates and corporations which have not

elected to be treated as a domestic corporation under IRC §897(i).

For U.S. property dispositions subject to FIRPTA, the transferee

(purchaser) is required to withhold and remit to the IRS 15% of the

gross sales price to ensure that any taxable gain realized by the

seller is actually paid. The withholding rate is computed

differently for other foreign entities, such as foreign corporations

and trusts, which are required to withhold 35% of the capital gain

realized on the sale. The withholding tax rate on a partner’s share

of income is 39.6% for non-corporate partners and 35% for corporate

partners. For more information on FIRPTA, visit: www.irs.gov and

download IRS

Publication 515: Withholding of Tax on Nonresident Aliens and

Foreign Entities.

Who is a Non-Resident Alien?

A non-U.S. citizen who does not pass

the green card test or the substantial presence test is considered a

“non-resident alien.” If a non-citizen currently has a green card or

has had a green card in the past calendar year, they would pass the

green card test and be classified as a resident alien. If the

individual has resided in the U.S. for more than 31 days in the

current year and has resided in the U.S. for more than 183 days over

a three-year period, including the current year, they would pass the

substantial presence test and be classified as a resident alien. For

more on the definition of a non-resident alien, see Topic

851, Resident and Non-Resident Aliens.

Three Exceptions

to FIRPTA

-

Property to become buyer’s

personal residence. Section 1445 (b)(5) provides an exemption

for property acquired by a transferee that will be used as the

transferee’s personal residence. To qualify for the exemption, a

closing officer will generally require the transferee to sign an

affidavit stating that the amount realized (generally sales

price) is not more than $300,000, and that the transferee or a

member of their family intend to use the property as a personal

residence for at least 50% of the number of days the property is

used by any person during each of the first two 12-month periods

following the date of transfer

- Seller declaration of

non-recognition of gain or loss. The second exception to the

FIRPTA withholding requirements is the simultaneous 1031

exchange. The transferee is not required to withhold if “[t]he

transferor gives written notice that no recognition of any gain

or loss on the transfer is required because of a non-recognition

provision in the Internal Revenue Code or a provision in a U.S.

tax treaty.” Such notice is called a “Declaration and Notice to

Complete an Exchange” (1031 Declaration and Notice). A

transferee can rely on a 1031 Declaration and Notice only if:

(1) the foreign person completes a simultaneous exchange (i.e.,

the same day); and (2) the foreign person receives no cash or

mortgage boot.

Further, if the property was seller’s principal residence, where

the sale of property exceeds $300,000, a foreign seller’s notice

of non-recognition of gain based on Section 121 may not be

relied upon and an IRS withholding certificate is required even

though the exclusion may reduce or even eliminate the amount to

be withheld under Section 1445

3.

The third exception is for transactions in which the IRS has

issued a withholding certificate (Withholding Certificate) to

the foreign seller. The amount which must be withheld by a buyer

can be reduced or eliminated pursuant to the Withholding

Certificate. The transferee, the transferee’s agent or the

transferor may request a Withholding Certificate. The IRS will

generally grant or deny an application for a Withholding

Certificate within 90 days after its receipt of a completed IRS

Form 8288-B application.

Impact on Simultaneous Exchanges

Under the foregoing rules, a buyer of U.S. property

from a foreign person can rely on a 1031 Declaration and Notice only

if the foreign person exchanges U.S. property for other U.S.

property in a swap in which the foreign person receives no cash or

mortgage boot. Since many exchanges can involve payment of some cash

or debt reduction, the utility of a 1031 Withholding Certificate is

substantially reduced.

Impact on Delayed Exchanges

To the extent that the 1031 exchange

is not simultaneous, or if any cash or mortgage boot will be

received by a foreign person with respect to the disposition of U.S.

property, the buyer can only rely on a Withholding Certificate

issued by the IRS to a foreign person. As a result, foreign persons

desiring to engage in a delayed 1031 exchange should consult with a

tax advisor and apply for an International Tax Identification Number

(ITIN) and a 1031 Withholding Certificate well in advance of the

anticipated disposition of U.S. property holdings. For more

information, see ITIN

Guidance for Foreign Property Buyers/Sellers.

Steps Involved in Complying with FIRPTA in an

Exchange

-

First, consult with your tax

advisor and analyze if FIRPTA applies to you and your

transaction and determine if you are considered a “Foreign

Person” who is selling a U.S. real property interest.

- Next, explore if any

exceptions to the FIRPTA withholding apply to your situation.

For a more detailed explanation of these terms and exceptions,

review IRS

Publication 515, Withholding of Tax on Nonresident Aliens and

Foreign Entities and IRS

Form 8288, U.S. Withholding Tax Return for Dispositions by

Foreign Persons of U.S. Real Property Interests.

- If you are a Foreign Person,

then you must obtain a U.S. Taxpayer Identification Number (TIN)

from the IRS as follows:

- The next step is to apply

for a Withholding Certificate from the IRS.

- Notify the buyer of your

relinquished property that you have applied for a Withholding

Certificate.

- Prior to closing on the sale

of a relinquished property, contact a qualified intermediary to

have the necessary exchange documentation prepared and forwarded

to the closing officer so the transaction can be closed as a

1031 exchange.

- The exchange begins when the

relinquished property closes. The buyer must file IRS Forms 8288

and 8288-A to report and pay the amount withheld to the IRS by

the 20th day after the date of the relinquished property

closing.

PFAS and environmentally potential hazards:

What is PFAS?

Per- and polyfluoroalkyl substances (PFAS)

are comprised of synthetic organic molecule “chains,” most notably

perfluorooctanoic acid (PFOA) and perfluorooctanesulfonic acid (PFOS),

among others. PFAS are now common in industrial and post-industrial

societies around the world and have been found in air, soil, and

water.

Capital Gains Tax Brackets

|

Replacing Debt in a 1031

Exchange

Replacing Value of Debt

to fully Defer Taxes

Many

taxpayers (and tax

advisors) are under the

misconception that the

IRS mandates that they

must have equal or

greater debt on their

1031 Exchange

Replacement Property

(property taxpayer is

purchasing). This is not

the case. The taxpayer

does need to replace the

VALUE of the debt they

had on the Relinquished

Property (property

taxpayer is selling).

However, the debt does

not have to be replaced

with debt.

In replacing

the VALUE of the debt,

the IRS is not concerned

how the taxpayer

replaces that the debt.

In fact, the taxpayer

has a number of options,

including:

-

Traditional

Financing (another

loan from a lender)

-

Cash (other cash

that the taxpayer

has available)

-

Seller-Financing

(the seller of the

Replacement Property

finances the

purchase using a

Carryback Note)

-

Private Money

|

|

|

|

Disclaimer: The above brief descriptions are not to be construed as

legal or tax advice and is qualified in its entirety by the actual

closing documents. In case of any discrepancy, the actual closing

documents will control.1031FEC

recommends investors considering an IRS IRC §1031 tax-deferred exchange

transaction or

an IRS IRC

§721 exchange

include and consult their accountant and/or attorney.

|

|

1031 Exchange 101

1031

Strategy

1031 Tax Alert

October 22, 2004

IRS Publication

544

DST Entity

IRS Section 1031

Oil & Gas

Royalties

1033 Exchange 101

Using Exchanges to Postpone Capital Gains Taxes

1031

Developments-Easements & Other

453M

Duties of an Executor and

Trustee

|