|

|

|

|

Tax Efficiency Services Asset Transfer Advisor

Tax Deferral & Elimination Strategies for All Assets & Estates

for Owners or Beneficiaries of Land, Real Estate and Other Assets

|

A M&A background and experience in agriculture and energy allow FEC and Ken Wheeler Jr. to be familiar with tax advantages some tax professionals may not encounter. We assist with asset transfer by exchange and/or tax deduction assets as replacements plus advise entity & asset assignment to be most financially efficient for tax and estate goals. We provide unique strategies for asset sales and estate planning to potentially reduce or eliminate taxes. Can assist to divest, merge or purchase assets for most advantageous ownership with financial and estate goal consideration for owner goals. In the business world the benefits can increase cash flow and bottom line. |

1LessTax & PayNoTax Alternatives - Options- Assignments * Asset Transfer Advisor

Through Affiliate www.1031FEC.com Free Consultation Appointment

When Planning, Transferring, Flipping or Selling Any Property or Business

Summaries of Alternatives For Diversification While Saving Tax Expense

Your Own Tax Advantaged Opportunity Zones

Significant Asset Gain Protect Income Reduce Tax Burden Asset Diversification Protect Taxable Gains

SAVE with Tax Saving Alternatives For Asset Owners-Sellers By Following New Tax Code

with Maximum Tax Deductions & Liquid Income Real Estate - Pay No Tax Potential

Flipping Homes or Any Real Estate?

Protect Income Newest Tax Deductions Diversification Enhance EBITDA

Reduce Tax Burden Maintain Wealth

We do not market annuities, insurance or list real estate or businesses. We may, with client permission, refer to those who do.

|

REHAB PROJECTS - ENERGY INCOME PROPERTY ACQUIRED AT ADVANTAGED PRICE MANAGED PRODUCING OIL & GAS FIELD IMPROVEMENTS WITH INCREASING PRODUCTION VOLUME TECHNOLOGY Acquisition Allows to Reduce or Pay No Tax when selling any property Can replace IRC 1031 Like Kind Exchange without Limitations

Request Non-Disclosure Agreement (NDA) when visiting about confidential detail |

REHAB PROJECTS - COMMERCIAL INCOME PROPERTY

REHAB PROJECTS - INCOME PROPERTY ACQUIRED AT ADVANTAGED PRICE IMPROVED FOR HIGHER INCOME

Tax Deferred for Exchange

For tax deferral the IRS Section 1031 has been prominent. Current tax code allows more advantaged alternatives.

Project accounted and managed by high integrity experienced property management with positive track record

Personal plan for each client to maximize client goal; i.e. more or less current income or gain

Recorded ownership allows to market or sell owned income property or IRC 1031 to qualified real estate

Income can have tax shelter, more with cost segregation. Gain can have tax shelter.

Most projects plan to divest in three-four years. Potential to divest sooner or choose to continue in project.

LEGACYCHANGE

Your Personal Asset Estate LegacyChange Plan

LegacyChange Plans AKA Insured Grace Plans

Assisting to Preserve and Maintain Client Wealth

Assist tax elimination relief for your appreciated assets, sell, and pass through a third party non-profit company,

which generates a tax deduction that solves the tax problem with an insured grace contract

creating a guaranteed income stream that over time will replace the full value of the asset.

This prevents heir/beneficiary disagreements over sale of assets

as can be common in a trust or will. Any or all assets of monetary value are eligible.

LegacyChange Plan Basics

Grace or charitable bargain sale with installment contract (reinsured).

LegacyChange Plan acquires asset (by option contract)

LegacyChange Plan divests (sells) with non-profit tax advantages.

LegacyChange Plan pays seller with an insured installment contract.

Split interest transaction (multiple interest beneficiaries for non-profit)

&

ZERO DEBT PROJECTS - MANAGED NEW COMMERCIAL INCOME PROPERTY - ABSOLUTE LEASE

For Asset Owners and Sellers Conserving With Recession Resistant and Managed Real Estate

Tax Deferred for Exchange

For tax deferral the IRC Section 1031 is prominent. Cost segregation potential.

Project accounted and managed by high integrity experienced property management with positive track record

Higher income with 15-20 year absolute lease (no owner expenses) by major tenant for new income property

Recession resistant property category

Recorded ownership allows to market or sell owned income property or IRC 1031 to qualified real estate

Absolute lease: The renter pays all real estate taxes, all maintenance and all insurances with owner as beneficiary.

See more at www.LegacyChange.com

SALE LEASEBACK - ABSOLUTE LEASE - MANAGED

We invite interested parties to meet and know our property managers, CPAs and rehab principals.

One can have a mediocre income property managed by experienced good managers and have success.

One can have the best property managed by poor or less integrity managers and do poorly fail.

We work with the best managers and venture partners.

To visit as venture partners we will complete non-disclosure agreements as all parties financial detail is confidential.

Request Non-Disclosure Agreement (NDA) when visiting about confidential detail

|

OPPORTUNITY ZONES Opportunity Zones are development tool designed to spur development and job creation in certain communities. Opportunity Zones provide investors with a different tax tool than a 1031 tax deferred exchange, but can provide tax benefits if investments meet certain conditions. The Opportunity Zone program is a new investment vehicle created under a provision of the Tax Cuts and Jobs Act of December 2017. The program was developed to encourage investors to invest funds in economically distressed communities thereby stimulating economic development in these areas. When certain funds are invested in these communities, known as Qualified Opportunity Zones (QOZ), investors are able to enjoy immediate as well as eventual tax benefits. Such benefits can include deferral of gain, partial forgiveness of deferred gain and complete forgiveness of certain additional future gains if certain investment criteria are satisfied. A 10 year commitment for full advantage is a consideration.

Locations can be challenging which is the reason for encouragement to consider this method. One can learn more about the basics of Opportunity Zones here: https://www.irs.gov/newsroom/opportunity-zones-frequently-asked-questions You can find Opportunity Zone resources including a map of all designated Opportunity Zones here: https://www.cdfifund.gov/Pages/Opportunity-Zones.asp

Tax Defer-Deduct Comparison

|

Notes

|

There are various tax strategies involving selling property that is both a personal residence and investment property. If property is held partially for personal use and partially for investment, such as a working ranch with a house on it in which the owner lives, a portion of the gain from the sale of the personal residence is exempt from tax under IRC §121 and the remaining tax can be deferred under §1031. Revenue Procedure 2005-14 clarifies how Sections 121 and 1031 can be used at the same time in connection with the disposition of the same property. One can simplify without the §1031 exchange. LegacyChange and certain Income Rehab properties can defer or deduct all gain and depreciation recapture tax. The certain Income Rehab replacement property advantage is it can encompass only the gain allowing basis to be included to deduct gain and other tax. |

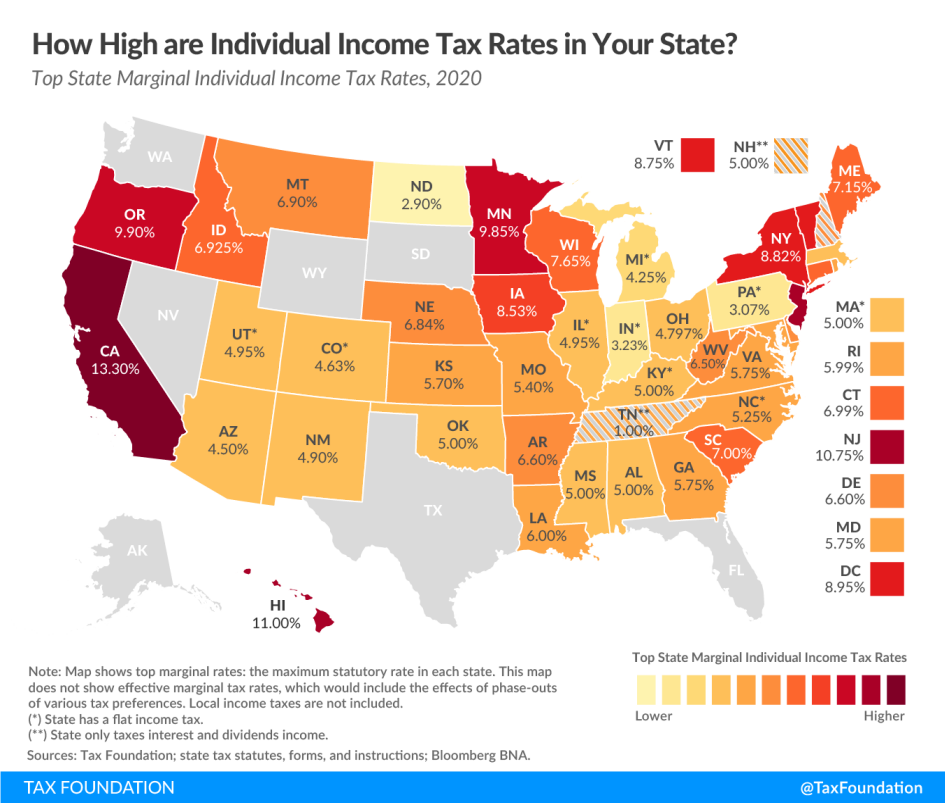

2020 State Tax Rates

|

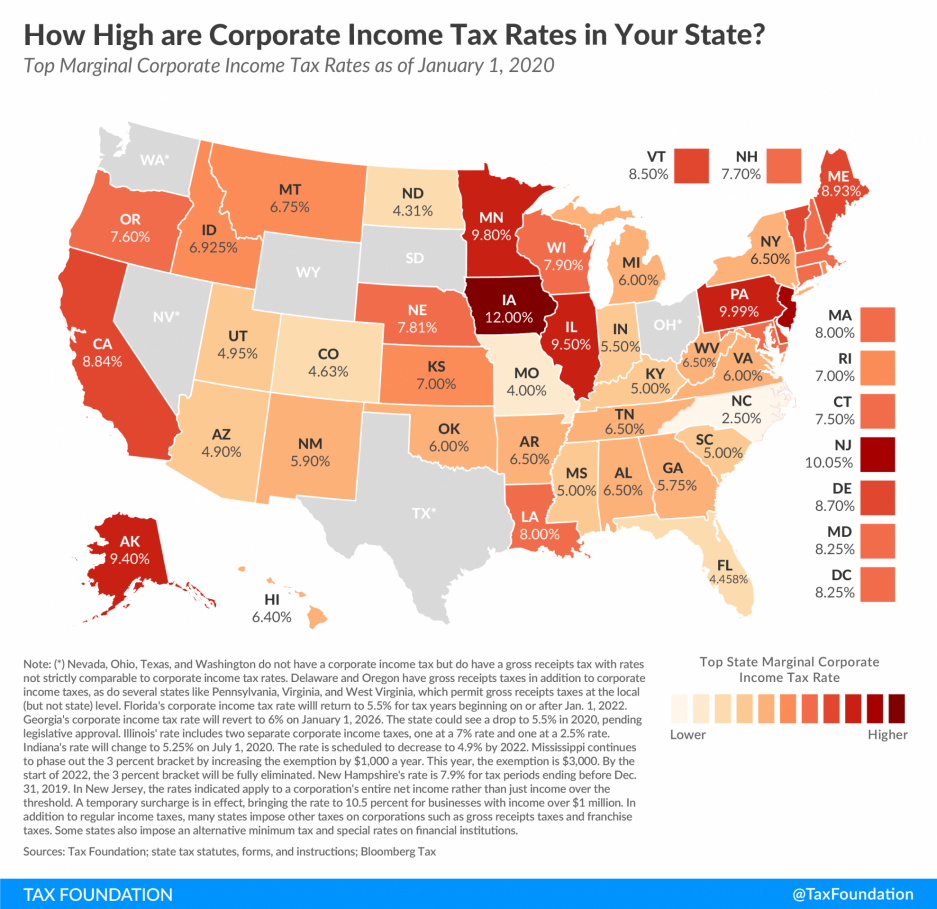

2020 State Corporate Tax Rates

Receive 1LessTax news & project updates subscribe here

Note: Your Personal or Business Tax Advisor is your final advisor for consultation. IRC 179-Bonus may be used.

Rehab & New Replacement Income Properties For Tax Planning

|

Other Influential 2018 IRS Code Current & past USA Taxable Income Brackets go here Figuring Depreciation Recapture IRC Depreciation and Recapture Rules Funder -LLC Member Qualification (PM3) Free Consultation & Discounted Experienced Local Will, Trust & Estate Advisors |

|

Site Contents: Home Page3 (Tax Alternatives) Page 4 (Sale-Leaseback) Page 5 (453MIS) Page 6 (Short Sale-Foreclosure Definitions) Page 7 (More Tax Reduction Rules) Page 8 (Probate-Titling-Land Trust) Page 9 (Business) CPA Page: Tax Credits & 1202 Asset Team: Advisors in One Stop Sell Annuity: Avoid Massive Tax Education (by PowerPoint) Business Page: Business I-Meet Schedule (1LessTax Informational Meetings) 1031FEC Page: (Net Investment Income Tax) To Disclaimer Page |

Veteran

C.P.R.E.S

|

Certified Probate Real Estate Specialist Ken Wheeler Jr. Mobile (515) 238-9266

Business Entry-Management-Exit

Plans - BEME

Tax Reduction - Legal - Estate - Tax

- Exit Strategies & Planning M&A Property Management Intermediary

Financial Exchange Coterie Florida International Trade Center 5206 Station Way Sarasota, FL 34233 Phone 800-333-0801 - Fax: 888-898-6009 Office (941) 363-1375 www.linkedin.com/in/kenwheeler65/ Licensed Real Estate Broker Asset Tax Advisor Contact us for free consultation For Tax Updates and News on Facebook View @1LessTax Tax and Legal Advisors always recommended. Thank you for visiting! |

|

Associated Websites: www.1031FEC.com www.LegacyChange.com www.PayNoTax.biz www.EternalLegacyTrust.com www.1EstateCare.com www.1exec.com www.FinancialEchangecCorp.com

Copyright © 2018 -2022 K. B. Wheeler Jr. All rights reserved. 5