Newsletter

§1031

Tax Update December 15, 2020 IRS/Treasury

Department

Latest IRC

§1031 Rules Release

Reduce Tax Burden -

Business, Real Estate, Stocks & More

Pay No Tax

-

Tax Deferred

§1031-§1033-§721-§453

deferred when selling or

exchanging real estate land, attached property, mineral rights,

certain leases, air

rights & water rights by exchange. Tax deferral for all types of assets,

properties & businesses.

Pay No Tax -

Tax

Deductible

Your

options

when selling-transferring residence, flip-rehab

homes, stocks, dividends, antiques, depreciated assets,

excess ordinary

income & other qualified capital assets!

Pay No Tax

- Tax

Excluded

Many US businesses &

properties qualify for tax exclusion of tax free gains & exchanges by Act of Congress

§1202-§1045

Pay No Tax

- Tax

Deferred

Real Estate Investment Trust IRC

§1031-§721

tax deferred to managed real estate (REIT) shares for income & estate planning.

Enter 1031FEC Website

Associated Websites and Alternate Tax Saving Plans

www.1LessTax.com

www.LegacyChange.com

www.EternalLegacyTrust.com

www.PayNoTax.biz

www.1EstateCare.com

www.AdvanceInheritFunding.com

www.PayNoTax.info

Follow current tax code.

Missed your 45 day or 180 day

limit for

§1031

Exchange? We have an alternate options to defer

or eliminate tax.

Inquire Here Email

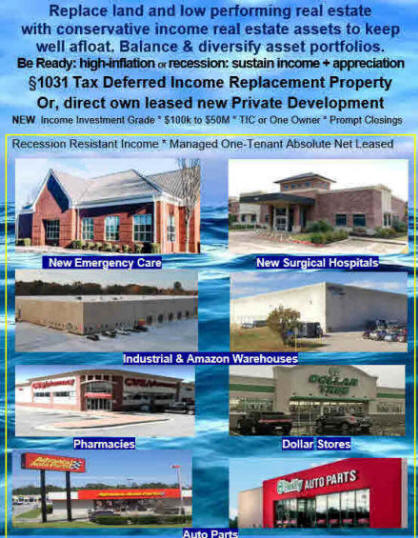

Request New

§1031 or purchase Replacement Property?

Inquiry Form

New Tax

Rules For Alternatives To Deductions For All Types Income

When one becomes owner of a

property or business is the time when one should plan for transferring

to new owners by exchange, legally

assigning beneficiary or written plan of continuation of ownership.

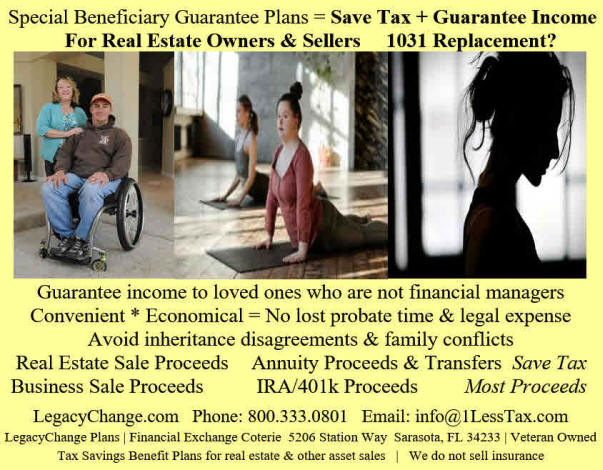

Stop Inheritance Conflict

- Tax

Savings - Guaranteed Income

Turn Heavily Taxed Annuities into

Tax Deducted Guaranteed Income

Ask us how by clicking here

1031FEC K B. Wheeler Jr.,

Financial Exchange Coterie is a Real Estate Broker

Go Direct To 1031FEC Property Managers (rehab)

for the income and

Tax advantage

replacing 1031 Exchange without time and $ restraint

Receive

1031FEC-PayNoTax-1LessTax

news & project updates-Free Consultation

subscribe here

What are your alternative advantage-solutions to your tax situation?

Contact

1031FEC

Free Consultation with Experienced Local Will, Trust & Estate Advisors

at

Discount

Go here

to Page TO REGISTER For More Detail, Free CPA

Consultation

For Informational Meet Link

Schedule Personal or Group Educational Webinar

Selling and paying taxes results in less capital to invest

to that of exchanging and reinvesting tax free.

Most transactions have proceeds that most will flow to new

investments. Your opportunity?

Thank you for visiting!

For Tax Updates and News View on Facebook

@AssetTaxPlan

Real Estate & Asset Titling -

Exit Strategies

Financial Exchange Coterie 5206 Station Way Sarasota, FL 34233

Direct 1(515) 238-9266 Phone:

800-333-0801 Messages Only 1(941) 227-3024 Trust Office:

1(941) 363-1375

FEC on Facebook:

@AssetTaxPlan

&

@1LessTax

Licensed Real Estate Broker

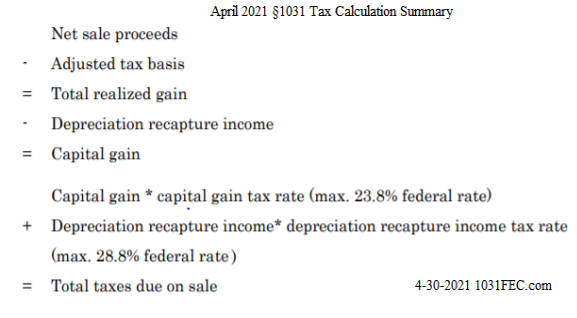

1031FEC April 2021

§1031

Tax Calculation Summary

Confidentiality/Non-Disclosure Agreement

“Booneisms”: “A fool with a plan can beat a genius with no plan”.

“Keep focused. When you are hunting elephants, don’t get

distracted chasing rabbits.”

453M a

b

c

NIIT

3-10

6-D

Copyright ©

2018-2021 K. B. Wheeler Jr. All rights reserved